This fall, Sowing Holy Question will explore questions of stewardship, reflecting theologically on practical decisions about money, possessions, ecology and our connection to God’s creation.

Jesus’s teachings on money can be a little embarrassing. Often it comes in the form of direct address, and this from the master of indirect communication and one-off parable. It’s a bit like T. S. Eliot looking you in the eye and saying, “Forget about Prufrock for a moment. Let me tell you what I really think of dinner parties.”

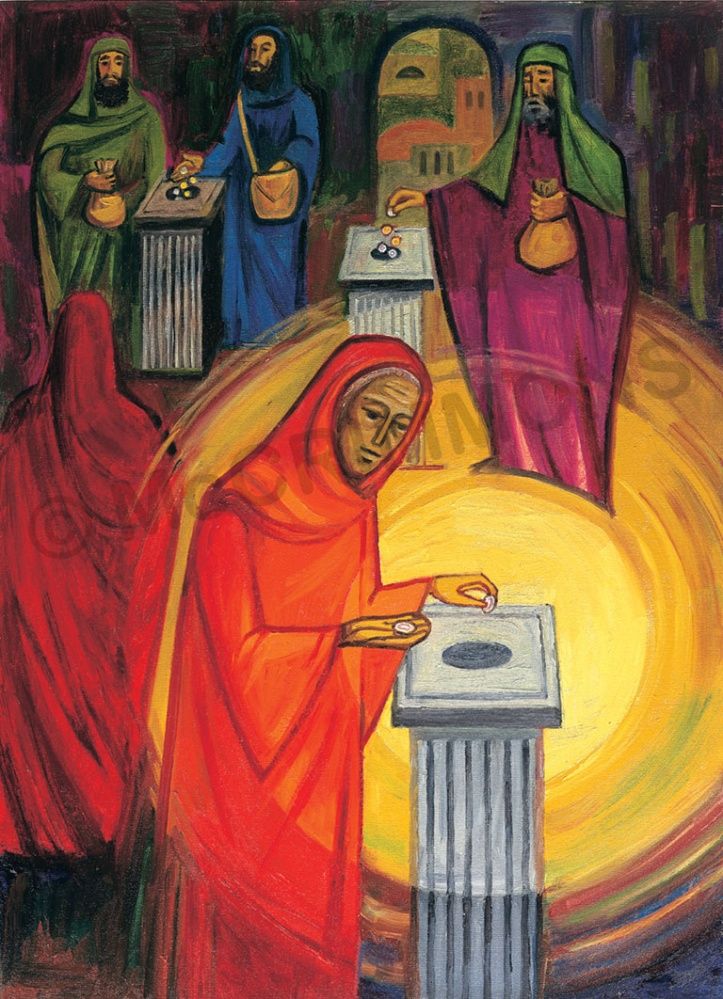

Take the rich young ruler, or the widow and her coppers, for example. There is no fictional scenario from which Jesus teaches his disciples, but an event that they experience. A rich man comes to Jesus for advice, and Jesus prescribes a fire sale. A poor widow stands in line with the Jews of means at the Temple treasury so she can put in her last penny. “Truly I tell you,” Jesus says, “she has put in more than they. Out of their abundance they have given some; but out of her poverty she has given all.” No one needs to pull Jesus aside and ask for translation, his blessing is reserved for the one who gives all.

The tendency in churches, I suspect, is to take Mark 10:17-22 and 12:41-44 as bits of messianic hyperbole, and then go back to asking people to give some. The entire structure of tithes and pledges is based on this logic. Figure up, per household, how much you can afford to give. Commit to that portion for a year. Approach ten percent as a goal, a mark achieved only through careful planning and years of habitual giving. This is a good “some.” But then there is the widow.

21st century capitalism is especially ill-suited to deal with the widow’s mite problem. The idea of emptying our pockets is especially offensive in an economy based on an appetite for limitless possibility. As my colleague Scott Bader-Saye puts it in a piece reflecting on the bank crisis of 2009, “The problem is not that we want too many material things; it’s that we want the possibility of all material things without having to actualize any of them.” For to the extent that we actualize—say, buy a home or an education, or give money to our children or to a charity—we decrease potential. Spent money no longer stands as a symbol of infinite potential; it has become a finite actuality. Of course, things are still purchased, and in North Atlantic world quite a lot of things. The zero-sum game of actuality and potential is dealt with, in this case, by increasing our potential to spend money we don’t have. I spent this months’ income on rent and groceries, but I can buy an iPhone or a car on credit. Credit cards are little bits of plastic infinity in our wallets, potencies that can never, or at least seem like they can never, be exhausted into the finitude of a material existence. If money is infinite, it is impossible to give all.

To put my point a little bit brashly: I’m not sure what Jesus would have said if the widow had put in her last penny, but then responded, “No, it’s alright,” and pulled out a Capitol One card.

The trouble with an economy based on infinite desire is that money first arrived in our lives as an instrument of justice, and only God is infinitely just: human desires must render themselves finite if we are to judge it as more or less just. So, as Aristotle taught us, we can measure finite goods and service against one another (shoes vs. medical treatment, in Bader-Saye’s example) by use of a common, or “just,” yardstick: money. But when money ceases to be a measure of commensurable goods, and becomes instead a tool for its own accumulation, it loses the ability to be a tool for justice.

Consider the rise of home mortgages through the 20th century. For many conservative families, the idea of a home loan that would take decades to pay off was once unthinkable. Marxist analysis has shown that there was cooperation between banks and bosses in the postwar era that helped change this mindset, for the simple reason that workers paying a mortgage are less likely to go on strike. So attention to justice decreases in inverse proportion to the increase in potential to loan money and to spend someone else’s money. Those who are less free financially are more inclined to ignore injustices, whether committed against themselves or another.

The church has a name for the attempt to reserve money as infinite potential over and above its use for finite exchanges. It is the sin of usury. Paraphrasing Thomas Aquinas’ definition, usury ensues when we construct exchanges around the philosophy that money exists to make more money.

Many churches see this problem clearly enough. Many make valiant efforts to stem the tide, engaging in various forms of the ancient Christian practice of alms-giving: clothes closets, food pantries, second-hand shops. The trouble though is that the same churches make themselves complicit in the culture of usury by the way that they raise their own funds. When we overlook systemic injustices in our econoverse, as Robert Lupton has argued, our charity turns toxic. In fact, by playing the capitalist game even while our charitable actions show that we know better, churches add to the sin of usury the sin of simony, or the making grace available for purchase. I’d better unpack that a bit.

Once a well-intentioned preacher challenged her parish to make their checks to the church the largest withdrawal from our account each month. A substantive and perhaps worthy challenge. The trouble with it, though, was that so many of us (yes, I was in attendance that morning) were swimming in student loans, mortgages, rising rent prices, and credit card debt, that the challenge was easily dismissible by most of us as entirely unrealistic. At the same time, the folks of means in the congregation were being handed a get out of jail free—or on the cheap—card. Suppose a single mother in the congregation, entrapped by rising rent that was forcing her into greater debt, had as her landlord another member of the congregation. He may meet the preacher’s challenge with immunity; she fails. This is what I mean by simony. The wealthy are often in position, especially during pledge season, to buy their way into heaven; the poor may be shamed or patronized (“$150 this year? Good for you!”), but the root causes of the inequity is not one that most congregations are equipped to broach.

To be blunt again: The church in effect often says, “Give us ten percent, and we promise to ignore the other ninety.”

I don’t think the preacher was wrong, necessarily, in the challenge, but rather in not following up with us. “Why have your rent prices gone up so much?” “Why are student loans forcing you into years of financial hardship?” “How is it that you are able to give so much, when those who live in your houses are so hard up?” These are questions not resolvable in a month. They are dangerous questions that could see a church engaged in some intense, radical, and creative ministry. And risky. Let’s not dismiss the real and frightening risk that the big givers might walk.

Among the many challenges to this follow-up kind of work is that money is at least as private for most of us as sex. Perhaps more so. But money is about justice, and “private justice” is an oxymoron. If we hope as churches to challenge the sin of usury, and to avoid flirting with simony, we must reclaim a public discourse on finances. We’ll have to talk about what we make, and how we spend it. It may be worth noting that Jesus was only able to comment on the widow’s offering because he saw her give it.

This brings us back to her coppers. How it is possible to give all?

In the middle ages, before the arrival of the capitalists (a term which referred, in early modernity, to that class of merchant who produced no other good or service than capital itself), parishioners were challenged to give all the excess of their income to the church. This excess was different for everyone, and was always related to social responsibilities of the person in question. A landowner responsible for the lives and families of serfs had greater expenses than a butcher or a weaver. But the questions to be asked were the same: How much money do you earn? How much do you need to maintain your own life, and those for whom you are responsible? How much do you need to save, so that you can continue to maintain these lives into the future? Now: How much is left?

One of the ironic losses in the modern era, driven as we are by the infinities of desire, is excess. If I am $100,000 in debt, I will never have money left over at the end of the month. If I am not, but am committed to re-investing my capital each month to grow more capital, I will have no excess. In this kind of environment, a church survives by forgetting about excess and begging to become a line item in a household budget. “While you’re paying inflated mortgage premiums, paying down your VISA, and investing what’s left in various questionable enterprises, please save room to give some to God.” But God doesn’t want some. God wants all.

So can we agree that the culture of 21st century capitalism leaves little room for the kind of excess that makes room for justice, replacing it with a kind of excess that is unjust at its core? How might we create a different kind of cultural space with the way we exchange money?

Here is an incremental proposal that might get us started:

- Churches need to begin to find ways to hold public conversations about personal finances.

- From these conversations, a community may begin working together to create pockets of excess where none presently exist: Challenging a capitalist who uses the excess only to make more money, or working with the middleclass family to find ways out of debt, or assisting the poor not just with charity but with interventionist action to create potential for just exchange.

- The goal of these conversations would not be to increase pledgers or tithers, but rather, eventually, at least in my dream scenario, to do away with both. Rather than promise to give a certain portion each month, parishioners would be pledging to use their income carefully and wisely (ideally this would involve money set aside not only for the rent, but also for parties, nights out, and college and retirement), and then give everything else to the church.

All of this would take time, of course, along with a good deal of creativity and patience. Those currently without any excess would need to go on pledging “some” till they can give “all.” But wouldn’t even these incremental steps install a cultural of possibility, and a new attention to justice, in our churches? Can you imagine a space in which rich, poor, and middle-class alike were all invited to give like radical widows?

Reference List

Thomas Aquinas, Summa Theologiae II.II.77-78.

Scott Bader-Saye, “Flirting with Money,” http://theotherjournal.com/article_author/scott-bader-saye/,accessed January 7, 2015.

John Bossy, Christianity in the West, 1400-1700 (Oxford, 1985).

Robert Lupton, Toxic Charity: How Churches and Charities Hurt Those They Help, and How To Reverse It (HarperOne, 2012).

Dr. Anthony D. Baker joined the seminary faculty in 2004. He teaches classes in both historical theology (focusing on a figure, an era, or a school of thought) and constructive theology (the building of persuasive arguments about God and creation). He is the author of Diagonal Advance: Perfection in Christian Theology as well as various articles in Modern Theology, Political Theology, The Journal of Anglican Studies, Anglican Theological Review, Heythrop Journal and other journals and collections. He is currently working on a book that explores theological themes in the works of Shakespeare. Professor Baker is the theologian-in-residence at Saint Julian’s Episcopal Church in north Austin, where he and his three children attend.